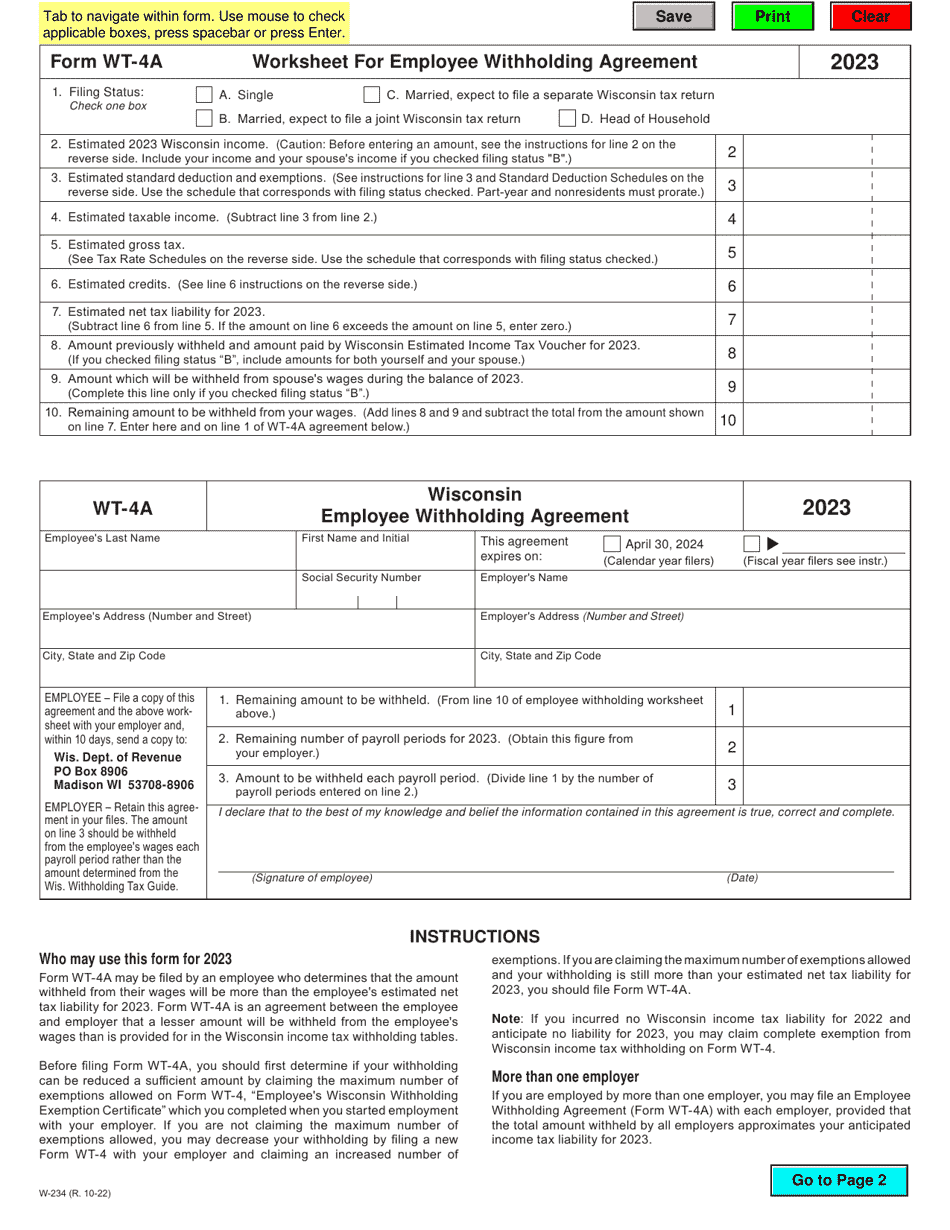

California State Tax Withholding Form 2025 C. Divide the annual california income tax withholding by > 26 < to obtain the biweekly california income tax withholding. Employees who work in a locality with state income tax must fill out a withholding form.

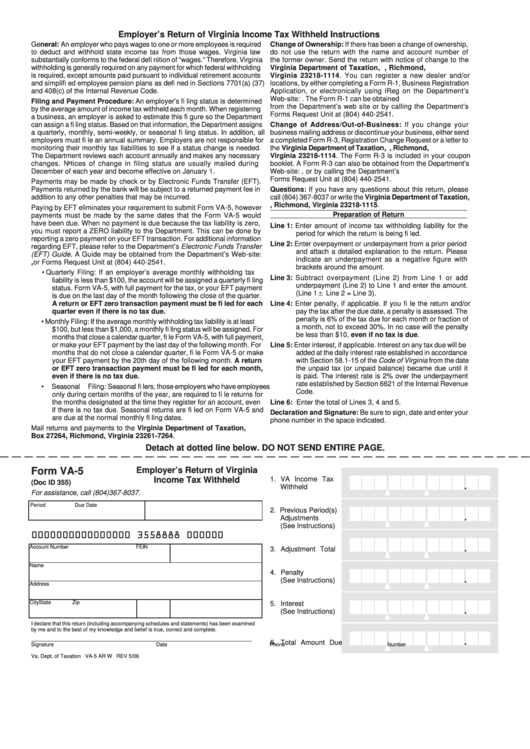

California 2025/25 state tax forms. California’s unemployment insurance code, in division 6, chapter 3, provides for withholding exemptions.

California Withholding Schedules For 2025 Betty Chelsey, Changes for california income withholding tax in 2025. Please select a pay period.

California Tax Withholding Form 2025 Rafa Ursola, Employees who work in a locality with state income tax must fill out a withholding form. Consider regular retirement fund contributions, as it reduces your taxable income and tax liability.

New California Tax Laws 2025 Darla Harlene, The de 4 form, or employee’s withholding allowance certificate, is used by california employees to determine the number of withholding allowances they claim for state tax purposes. Use the california tax form calculators as a stand alone tax form calculator to quickly calculate specific amounts.

State Withholding Form 2025 Cherin Lorianne, Section 13040 requires an employer to use the. How to calculate 2025 california state income tax by.

De4 Worksheet A / California De4 V2 This Form Can Be Used To Manually, California’s unemployment insurance code, in division 6, chapter 3, provides for withholding exemptions. Section 13040 requires an employer to use the.

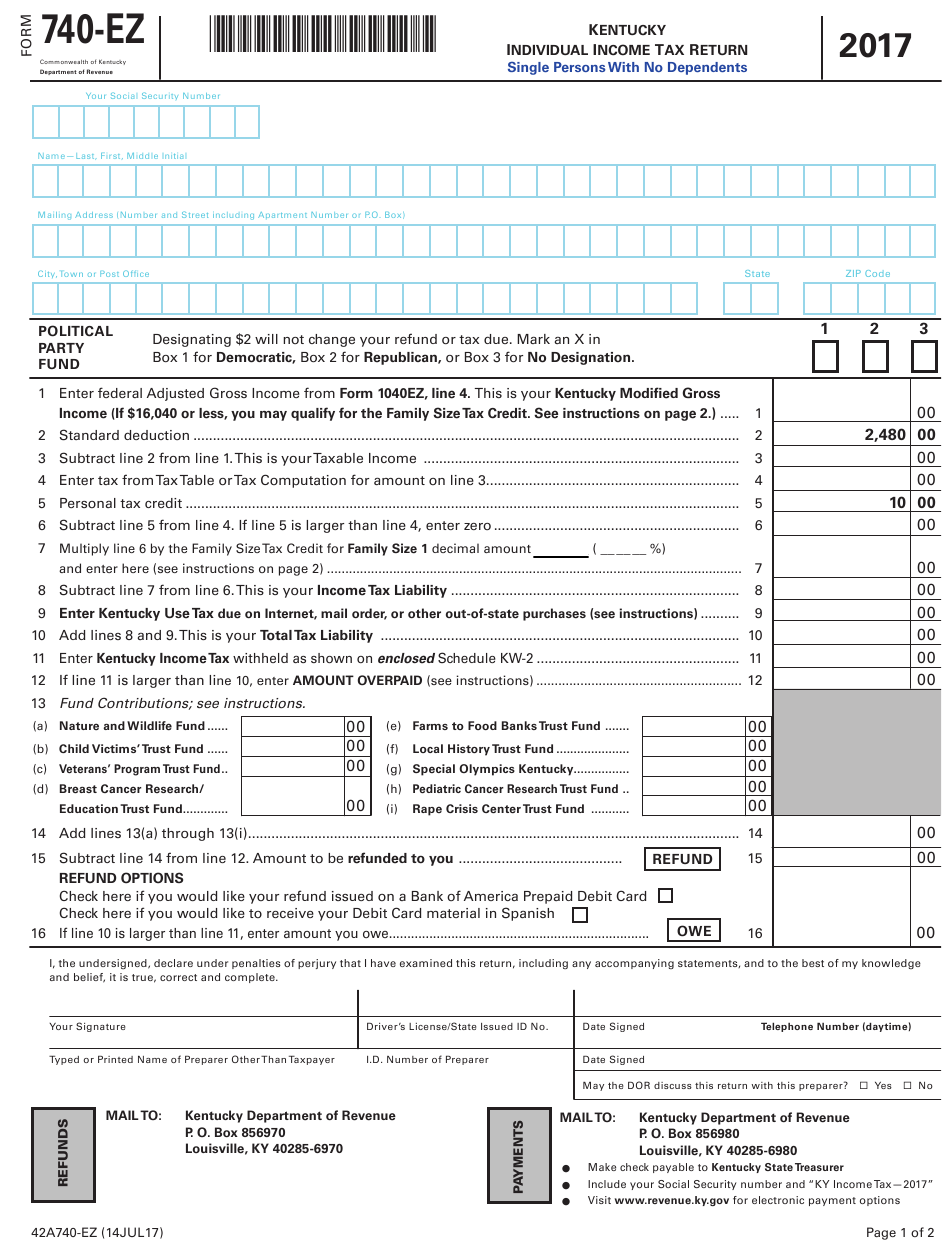

Kentucky Withholding Form 2025 Marin Sephira, In this calculator field, enter your total 2025 household income before taxes. Annual payroll tax deadlines in california:

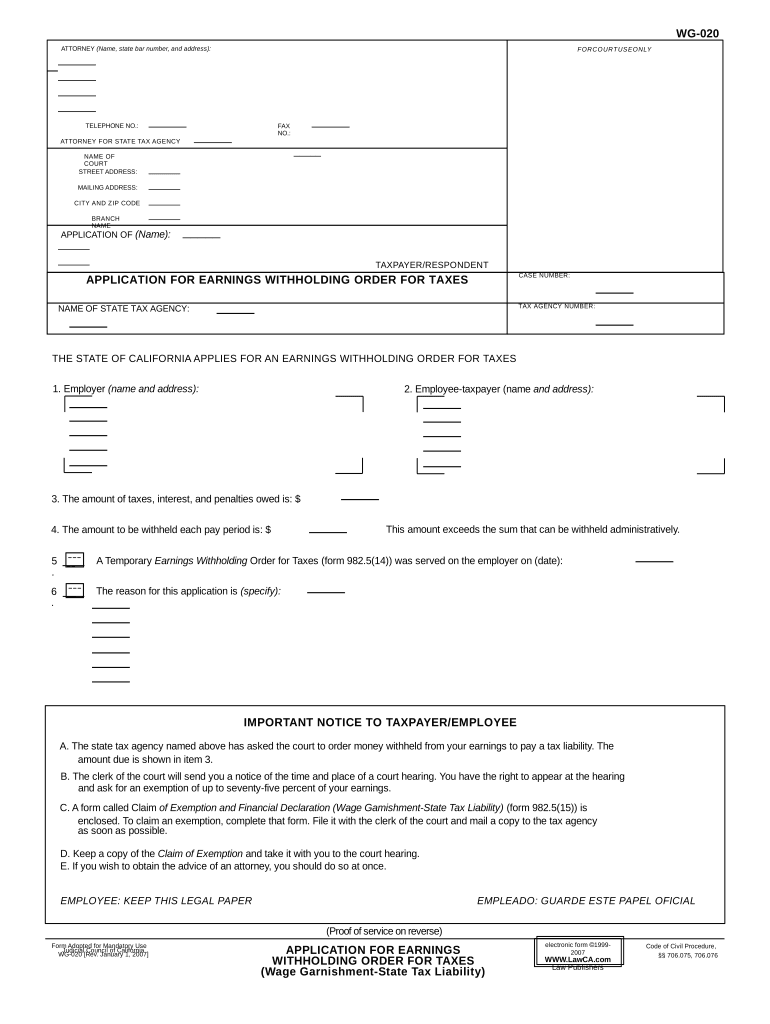

California State Withholding Tax Form, This form allows each employee to. Read these instructions before completing this form.

Ca state tax withholding form Fill out & sign online DocHub, The beginning of the new tax year. Divide the annual california income tax withholding by > 26 < to obtain the biweekly california income tax withholding.

California State Tax Withholding Table 2025 Dede Rosamond, That tax, described in the federal unemployment tax act, or futa, requires employers to pay 0.06 percent on an employee’s first $7,000 of pay. Employees must complete form w4 with the correct information.

California Tax Withholding Form 2025 Rafa Ursola, California increased the annual standard deduction amount standard deduction table. That tax, described in the federal unemployment tax act, or futa, requires employers to pay 0.06 percent on an employee’s first $7,000 of pay.

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california.